japan corporate tax rate 2018

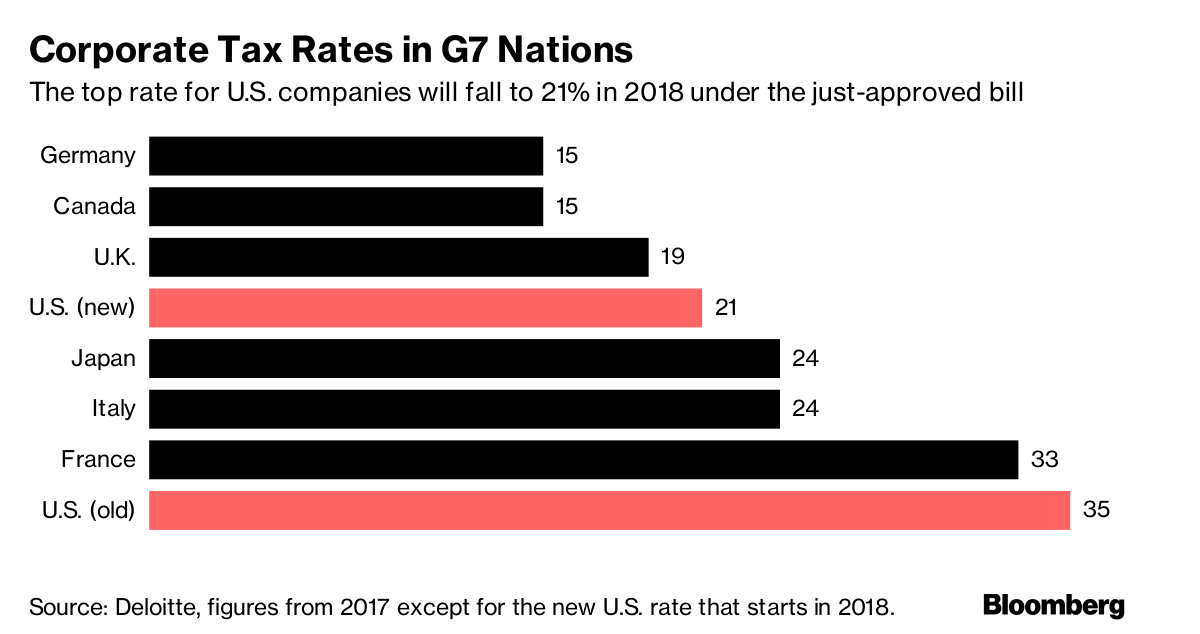

The average top corporate rate among EU countries is 2168 percent 2369. Paid-in capital of over 100 million.

Charles Schwab Market Commentary Global Impact Of A Blue Wave Election Outcome

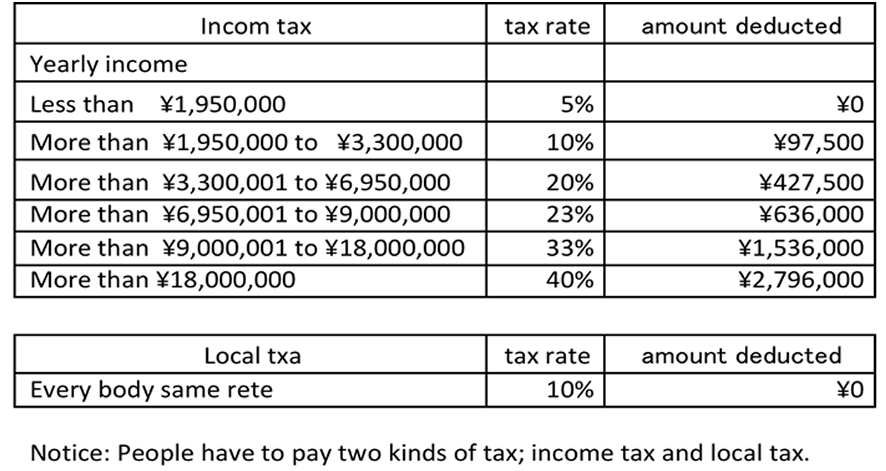

Tax rates The tax rate is 232.

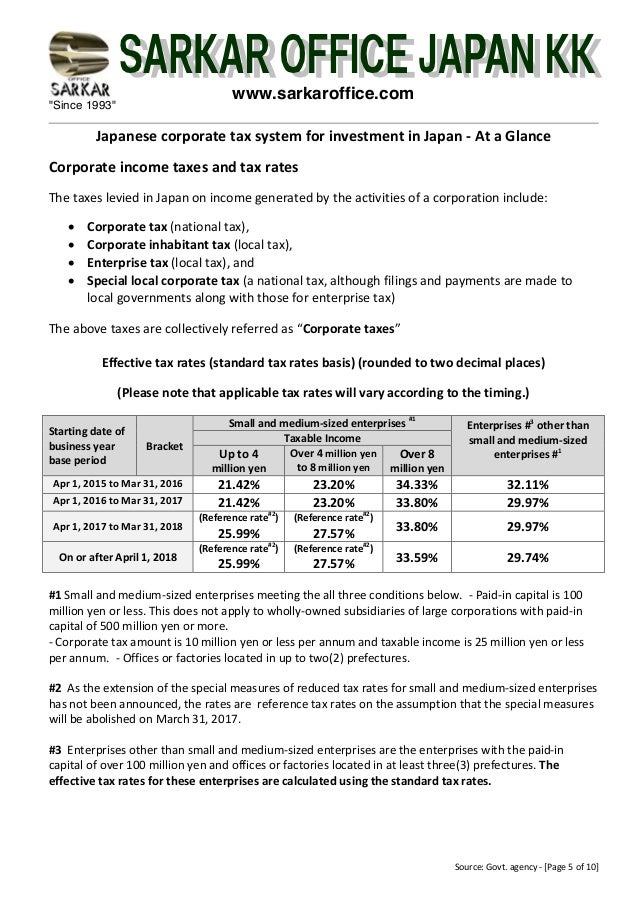

. Business year A business year is the period over. Enterprise tax and special local corporate tax are taxed based on corporate tax amount of a company however corporations with paid-in capital of more than 100 million Japanese yen are. The maximum rate of 147 percent is levied in Tokyo metropolitan.

KPMGs corporate tax table provides a view of corporate tax rates around the world. 6 The special local tax is 81 percent of the prefectural enterprise tax for. The tax rate for small and medium-sized enterprises with the capital of 100 million yen or less is 15 for those with an annual income of 8 million yen or less and 234.

Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. Under Section 15a corporations determine their federal income tax for fiscal years that include January 1 2018. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020.

Details of Tax Revenue Japan. Year Taxable Income Brackets Rates Notes. The maximum rate was 524 and minimum was 3062.

Government at a Glance. Corporate Inhabitant taxes 2. 5 Standard rate 123 percent of the central tax.

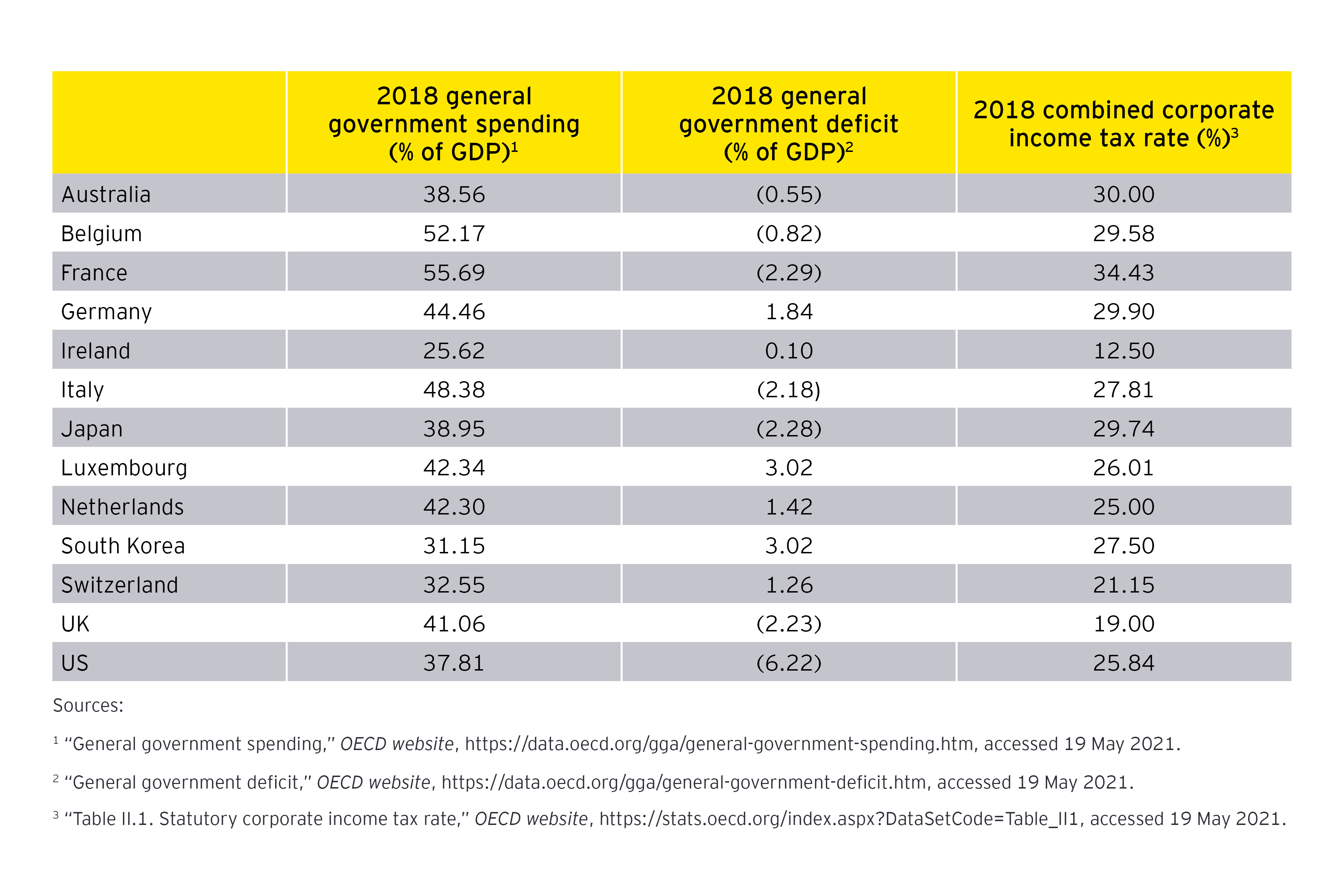

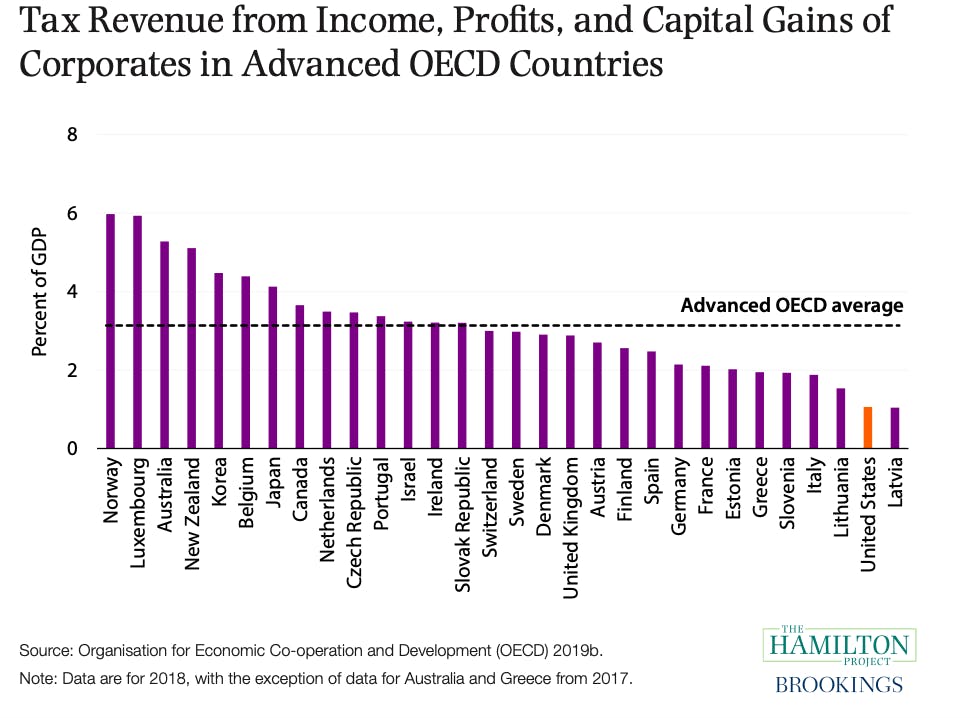

In fiscal 2018 it was 261 percent in terms of national and local taxes combined 160 percent for national tax and 101 percent for local tax. 5 rows Corporation tax rate 1 April 2016. Data published Yearly by National Tax Agency.

Produced in conjunction with the. Japans ratio is lower in. Regulation in Network and Service Sectors 2018.

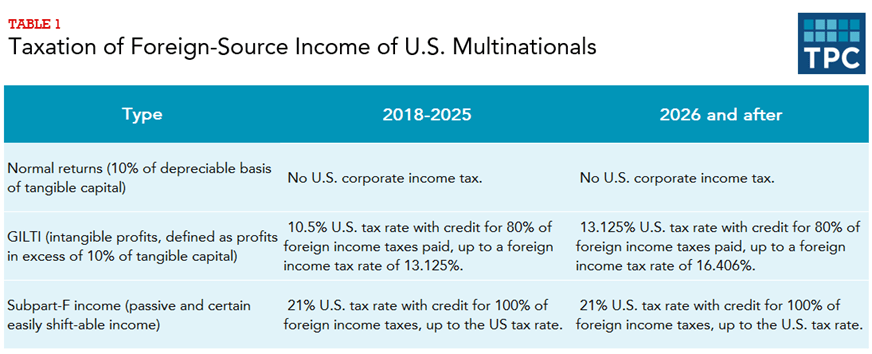

The G7 which is comprised of the seven wealthiest nations in the world has an average statutory corporate income tax rate of 2669 percent and a weighted average rate of. Taxpayers need a current guide such as the Worldwide Personal Tax and PDF Country Tax Profile. They first calculate their tax for the entire taxable year using the tax rates in.

Use our interactive Tax rates tool to compare tax rates by country or region. Corporate Inhabitant taxes 1. Corporate tax rates table.

Final tax return Corporations are. For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less. Now in 2018 the average corporate tax rate is 2647 percent and 2303 when weighted by GDP.

Details of Tax Revenue Korea. 2018-2020 All taxable income. Product Market Regulation 2018.

The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax.

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

How Does The Current System Of International Taxation Work Tax Policy Center

Corporate Tax Rate Pros And Cons Should It Be Raised

2 Toward Improvement Of The Business Environment Jetro Invest Japan Report 2016 Summary Reports Why Invest Investing In Japan Japan External Trade Organization Jetro

What Largest Tax Overhaul In 30 Years Means For Companies Bloomberg

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

The Four Decade Decline In Global Corporate Tax Rates Reuters

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax In The United States Wikipedia

How A Global Minimum Tax Would Deter Profit Shifting And One Way It Would Not Piie

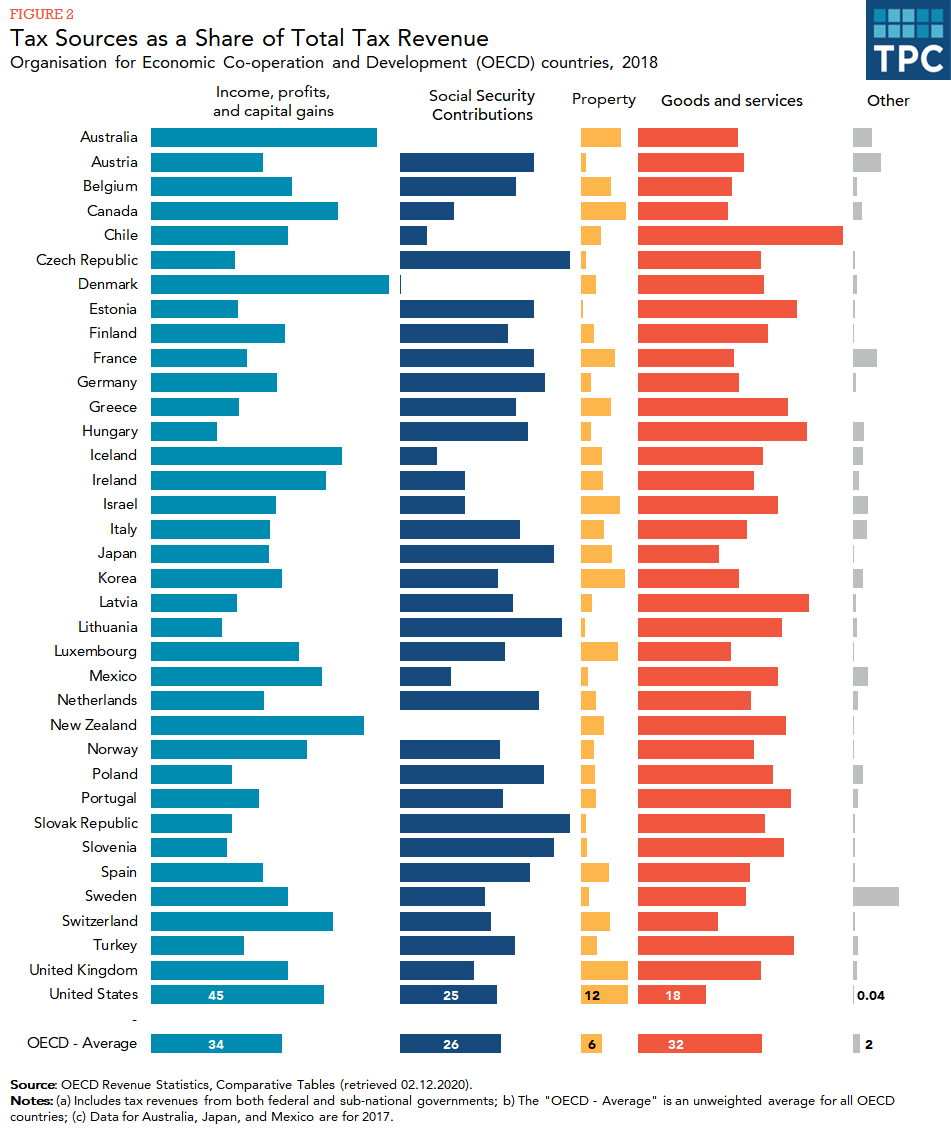

How Do Us Taxes Compare Internationally Tax Policy Center

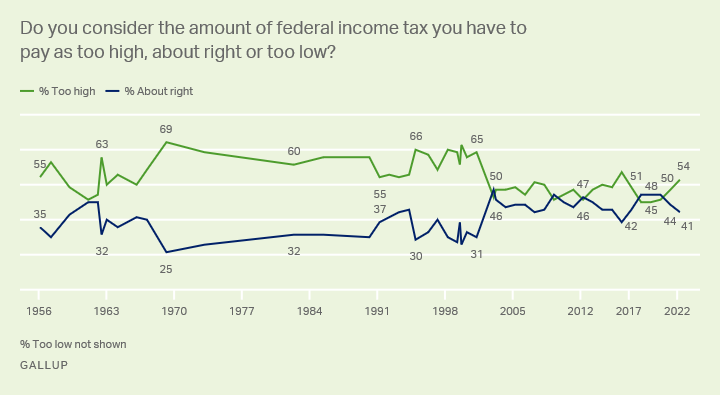

Taxes Gallup Historical Trends

How The Big Tax Reboot May Impact Singapore Ey Singapore

Senate Republicans Want Your Cleaning Lady To Pay Income Tax But Not Fedex The New Republic

As Some Major Economies Cut Their Corporate Tax Rates What Will Happen Next World Economic Forum